The “waiting game” for Canadian mortgage holders is officially over. As we enter the second half of February 2026, the economic landscape has shifted from a state of emergency to a period of “Structural Adjustment.” While the Bank of Canada (BoC) maintained its policy rate at 2.25% in January, a new invisible tax has appeared for those facing a 2026 mortgage renewal: the USMCA Trade Premium. This situation has led to concerns about mortgage payment shock 2026 and highlights the importance of understanding 2026 mortgage renewal strategies.

If you are one of the 1.5 million Canadians renewing a pandemic-era mortgage this year, you are standing at a financial crossroads. Your decision this month will determine whether you pay a “Loyalty Tax” to your current bank or deploy a 2026 mortgage renewal strategies that protects your household equity for the next decade and shields you from potential mortgage payment shock 2026.

The “Neutral Rate” Trap: Why 2026 is Different

Understanding the implications of mortgage payment shock 2026 is crucial for making informed financial decisions.

For years, the goal was simple: wait for the Bank of Canada to cut rates. However, with the BoC currently sitting at its “Neutral Rate” of 2.25%, the floor has been reached.

Despite this, fixed mortgage rates remain stubbornly high, often quoted between 4.05% and 4.35% at major institutions. Why? The answer lies in Government of Canada bond yields. Because of the upcoming July 2026 USMCA trade review, bond investors are demanding a higher “risk premium.” This creates a disconnect: the BoC is helping, but the market is hesitating.

Key Stats: The February 2026 Market Reality

- BoC Policy Rate: 2.25% (Next Update: March 18)

- Current 5-Year Bond Yield: 2.85% (Inflated by trade uncertainty)

- Average Payment Increase: 18%–24% for 2021-cohort borrowers.

- The “Lender Spread”: 0.40% (Additional margin added by banks for recession risk).

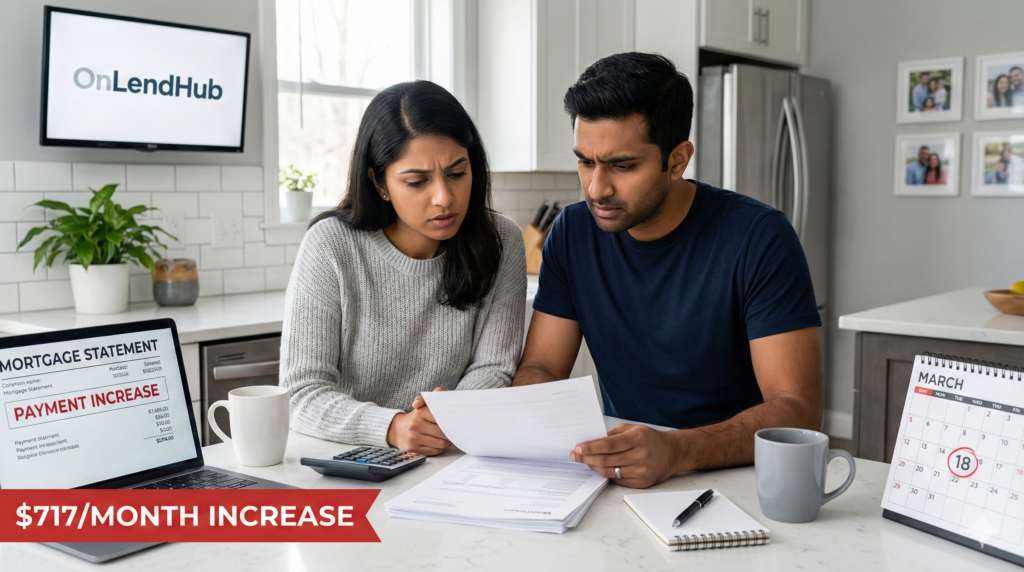

Case Study 1: The Ahmed Family’s $8,400 Mistake

The Ahmeds, living in a detached home in Milton, Ontario, represent the “average” Canadian success story—until now. In early 2021, they secured a 5-year fixed rate of 1.79% on their $600,000 mortgage. Their payment was **$2,475/month**.

When their renewal letter arrived last week, the bank offered 4.29%.

- The New Payment: $3,175/month.

- The Shock: $700 extra per month.

The Ahmeds initially planned to just sign the letter. “It’s only a few hundred dollars,” they thought. But $700 a month is **$8,400 a year**. Over a 5-year term, that is $42,000 in extra interest they would never get back.

By applying the “3-Year Bridge” strategy (Strategy #1 below), they were able to secure a rate of 3.74%, dropping their payment jump by nearly 40% and saving them over $15,000 in interest costs.

Strategy #1: The 3-Year Fixed “Bridge”

In 2026, the 5-year fixed mortgage is no longer the “safe” option—it’s a cage. If you lock in for 5 years today, you are betting that the USMCA trade volatility and the current “Neutral Rate” won’t improve until 2031.

The 3-Year Fixed Bridge (currently averaging 3.75%–3.95%) is the optimal move for three reasons:

- Macro-Economic Timing: It allows you to “bridge” over the July 2026 trade review and the 2027 economic cycle.

- Rate Flexibility: Forecasts suggest that by 2029, the global economy will enter a new growth phase, likely pulling rates back toward 1.75%–2.0%.

- Lower Break Penalties: If you need to sell your home in a “subdued” market, breaking a 3-year term is significantly cheaper than a 5-year term.

Strategy #2: Variable Rates as the “Recession Hedge”

Variable rates are currently quoted around Prime – 1.10% (roughly 3.35%). This is significantly lower than most fixed offers.

If the 2026 USMCA review leads to a “subdued” recession, the Bank of Canada will be forced to cut the policy rate below 2.25%. Variable-rate holders will be the immediate beneficiaries. For the first time in three years, the risk of variable is outweighed by the massive “spread” advantage it currently holds over fixed pricing.

Strategy #3: Strategic Refinancing to Reset Amortization

For many families, the 2026 mortgage payment shock is a math problem that can’t be solved by interest rates alone. If your payment is jumping by $700, and your budget only has room for $100, you need Amortization Compression Relief.

Case Study 2: Sarah’s “Cash Flow Rescue”

Sarah, a self-employed professional in Vancouver, saw her monthly payment set to jump from $3,200 to $4,100. Even with a competitive rate, her business income couldn’t absorb the $900 hit.

The Move: Instead of renewing, Sarah refinanced. By resetting her amortization from 18 years back to 30, she dropped her contractual payment to $3,150.

- The Result: She actually lowered her monthly obligation while rates went up.

- The Strategy: Sarah plans to make lump-sum prepayments (up to 20% per year) once her business picks up, but the lower contractual payment gives her total “Budget Oxygen” during the volatile trade season.

Strategy #4: Debt Consolidation — The “Loonie-for-Loonie” Swap

As of February 2026, consumer debt in Canada is at record highs. If you are renewing a mortgage at 4.1% while carrying a credit card balance at 21.99%, you are losing the wealth-building war.

Rolling $50,000 of high-interest debt into your mortgage renewal might seem like you’re “adding to the mortgage,” but you are actually lowering the cost of your total debt.

- **Credit Card Interest on $50k:** ~$915/month.

- **Mortgage Interest on $50k:** ~$170/month.

- Total Monthly Savings: $745.

Strategy #5: The 120-Day “Rate Hold” Shield

Volatility is the enemy of the renewer. Most Canadian lenders allow you to “lock in” a renewal rate 120 days before your maturity date.

If your mortgage matures in June 2026, you should be talking to a broker right now. A rate hold is an insurance policy:

- If trade wars cause rates to spike in March, you are protected at today’s rates.

- If rates drop further, your broker will “float” you down to the lower rate before you sign.

Deep Dive: The USMCA Review and Your Mortgage

Why does a trade deal between Canada, the U.S., and Mexico matter for your Milton townhouse?

Fixed mortgage rates are tied to bond yields. Bond yields are tied to inflation expectations. If the USMCA review (scheduled for July 2026) suggests that trade will become more expensive (tariffs), inflation will stay high. If inflation stays high, bond yields won’t drop.

By understanding this “geopolitical tax,” you can see why the big banks are hesitant to lower rates further. They are waiting for the trade smoke to clear. You, however, shouldn’t wait. You need to position yourself with a 3-year bridge or a variable hedge now.

FAQ: Surviving the 2026 Renewal Peak

Will mortgage rates go down further in 2026?

Consensus suggests stability. The BoC is at its 2.25% neutral floor. Significant declines are unlikely unless Canada enters a deep recession, which would be a “double-edged sword” for homeowners.

Can I switch lenders at renewal without a penalty?

Yes. At renewal, you are a “free agent.” You can move your mortgage to any lender in Canada to get a better rate. The new lender will often even pay your appraisal and legal fees to get your business.

What is the “Loyalty Tax”?

It is the higher interest rate banks offer to existing customers, assuming they are too busy or too scared to shop around. Shopping around typically saves the average Canadian $13,857 over a 5-year term.

Your mortgage renewal is a business decision, not a loyalty test. Don’t leave your cash flow to chance.

Book your 2026 Renewal Strategy Call now → OnLendHub.ca

Take Action Today:

📞 Book Your Free Renewal Strategy Call

Schedule a 30-minute consultation with one of our licensed mortgage agents. We’ll review your current mortgage, discuss your renewal options, and show you exactly how much we can reduce your payment increase.

💰 Get Your Instant Rate Comparison

Apply online now and receive renewal rate quotes from multiple lenders within 24 hours. No obligation, no cost—just information you need to make a smart decision.

📊 Calculate Your New Payment

Use our free mortgage renewal calculator to see exactly what your payment will be under different rate and amortization scenarios.

💰Listen to our Podcast

Your Mortgage Minute is our 5-minute episode podcast offering valuable mortgage tips released on every Wednesday on Spotify, Apple Podcast, & Youtube