We handle your Mortgage Loan strategy

We will guide you through each step to ensure that you get the best mortgage rates, reduce your paperwork, and sail through the approval process. With onLendHub, you’ll be moving into your new home with confidence, prepared for today and tomorrow.

Mortgage Loan Pre-Approval Services

Pre-approval services are crucial for potential homebuyers. Agents guide clients through the pre-approval process, allowing them to understand their budget and financing eligibility before house hunting. This service reassures both buyers and sellers during negotiations.

Tell Me MoreFirst-Time Home Buyer Consultation

This service includes educating clients about various mortgage loan products, government incentives (such as the First-Time Home Buyer Incentive), and potential pitfalls in the mortgage process. Personalized guidance helps clients feel more confident in their decision-making.

Tell me MoreRefinancing and Renewal Assistance

Helping existing homeowners find better mortgage loan rates or terms when their contracts are nearing expiration. This service is particularly important as many homeowners look to take advantage of lower interest rates or change their loan conditions to suit their current financial situation.

Tell Me More

“We believe that by empowering our clients to make informed, calculated mortgage decisions, we will help strengthen communities and create a positive impact on the world around us.”

OnLendHub

Our MISSION

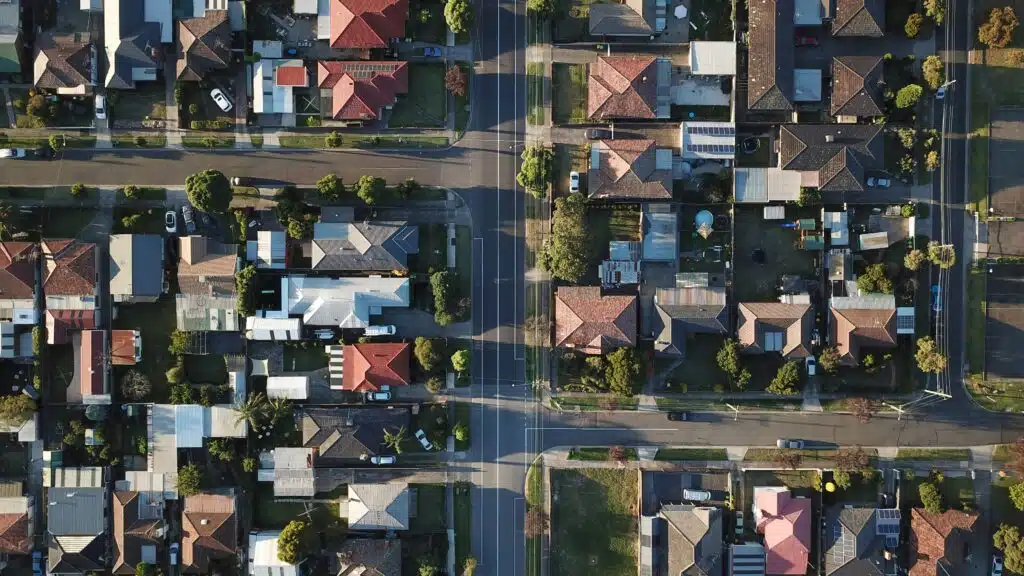

We bring people together

Our mission is to bring people together by making homeownership accessible for everyone. We strive to ensure that all clients have the opportunity to secure a home and pursue their dreams, fostering a sense of community and shared possibility.

Our Promise

Save time and effort

Exceptional support and services

Minimize risks

Enjoy peace of mind

Our Strengths

We offer a huge variety of mortgage choices that covers every need through our brokerage

65+

Lenders

7000+

Product options

14+

Categories

450+

5 Star Google reviews

Whether you’re buying a new home, interested in refinancing your mortgage, or your loan is up for renewal, we have a proven system for success.

FAQ

Ask us anything on mortgage, we are here to help

$1.5 million or more: 20% of the purchase price. If your down payment is less than 20%, you’ll need mortgage default insurance

Up to $500,000: 5% of the purchase price.

$500,001 to $999,999: 5% on the first $500,000 and 10% on the remainder.

The Bank of Canada’s qualifying rate (currently around 5.25%), or

Your contract rate plus 2%. This test applies to all federally regulated lenders and affects how much you can borrow.

Home inspection.

Land transfer tax.

Legal fees.

Title insurance.

Still have more questions?

Book a free 30-minute consultation call to get your questions answered

Book A Call